Instagram Story Download

Save Instagram Stories For Free

Looking to Instagram Story Download directly to your device? Our IG Story Downloader simplifies the process, allowing you to save Insta Stories effortlessly. Compatible with Windows and Mac computers, as well as iPhones and Android devices, it supports all operating systems.

How to Download Instagram Stories

Step 1 – Copy Insta Story URL

📱Open Instagram

Open Instagram, Tap on the share icon (⌲) then click on copy link.

To download a single story Instagram Story, use the copied URL, Which looks like “https://www.instagram.com/stories/wwe/3641082107561095783/”

To download all current stories from a profile use a url like “https://www.instagram.com/stories/wwe/“

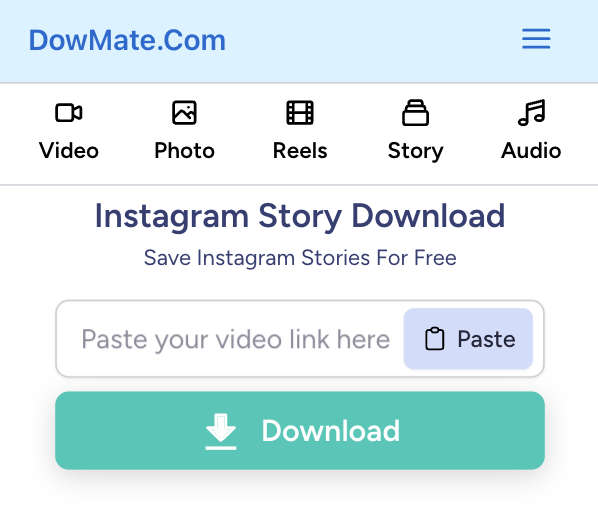

Step 2 – Paste & Convert

🌐Visit Dowmate

Open the website https://dowmate.com in your web browser. Paste the Instagram Story URL you copied from Instagram into the input box, then click the Download button to start converting the Instagram URL to an MP4 video.

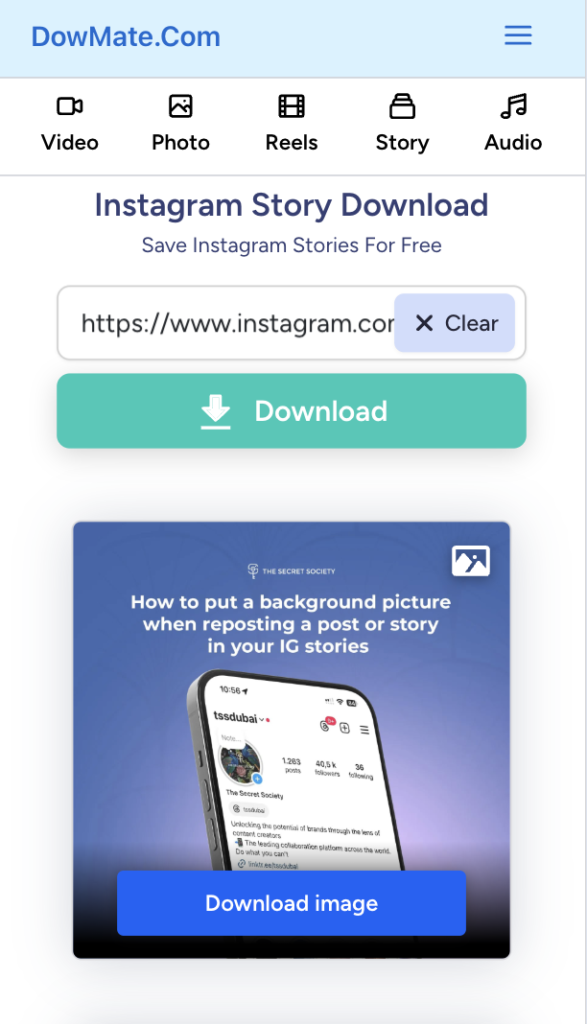

Step 2 – Download & Save

💾Save to Your Device

Once the conversion is complete, a download option will appear, allowing you to save the Instagram Story to your mobile device or computer.

The Story is one of Instagram’s features. It is a slideshow of pictures and videos that users can share for 24 hours with all their followers. People post them on Story to share different moments from their lives, from vacations to just hanging out at home. The fact that users can post content like photos or videos which will disappear in 24 hours adds another element of fun and engagement to Instagram.

Using Dowmate, we can easily convert Instagram stories to MP4 videos in high quality, up to 4K resolution. Online Instagram story savers are a superior choice compared to apps, as they require no installation of software or browser extensions. They are safe to use, do not require login or registration, and offer high-speed conversion and downloading with exceptional video quality.

How to save stories from private accounts?

We are sorry that we are unable to save a story or stories from a private account. Still, we are working on that feature very soon We will update it with Instagram private story saver feature.

How many times can I save Instagram stories?

There are no limits to the number of times you can save content. You have unlimited access to our Instagram story download service. It’s also completely free.

Is it legal to save Instagram Stories of other users?

Yes, you can use an Instagram stories downloader like our tool to save photos and videos from someone else’s profile. Many Instagram tools let you do exactly that. However, be aware that some people may not want their content saved by third-party applications or services. So, they keep their account private, and if you run into a particular user who objects to having their account scraped for content, respect their wishes and move on.

Is there a limit for the Instagram story download at a time?

No, there aren’t any restrictions. The entire collection of stories will be accessible for download. Dowmate Gives unlimited downloads facility for free.

Where can I find all the saved Stories?

All the downloaded content from Instagram Like stories, Photos, Videos, IGTV, and profile pictures were stored on Your device, Please check the gallery in Mobiles or check through File Manager ->Downloads. If you are using Dekstop/Computer please Check Downloads Folder.

How to Download Instagram Story For Free?

Open Instagram Application or Website, Click on the 3 dots Option icon

Then Copy the Instagram Story URL

Paste Insta story URL on Dowmate Input Search Box, Click Start Button

Now click on Download Button to Save Insta Story to Your Mobile or Computer.